What Is Medigap Fundamentals Explained

Table of ContentsHow Does Medigap Works for BeginnersNot known Details About Medigap Some Known Factual Statements About How Does Medigap Works The Basic Principles Of Medigap How Does Medigap Works Things To Know Before You Buy

You will require to speak to a certified Medicare agent for rates and accessibility. It is highly recommended that you purchase a Medigap policy throughout your six-month Medigap open enrollment duration which starts the month you transform 65 as well as are enlisted in Medicare Component B (Medical Insurance Policy) - How does Medigap works. Throughout that time, you can purchase any Medigap plan offered in your state, also if you have pre-existing problems.You could have to buy an extra expensive plan later, or you could not be able to buy a Medigap plan at all. There is no guarantee an insurance provider will market you Medigap if you request protection outside your open enrollment period. As soon as you have determined which Medigap plan satisfies your needs, it's time to figure out which insurance firms market Medigap policies in your state.

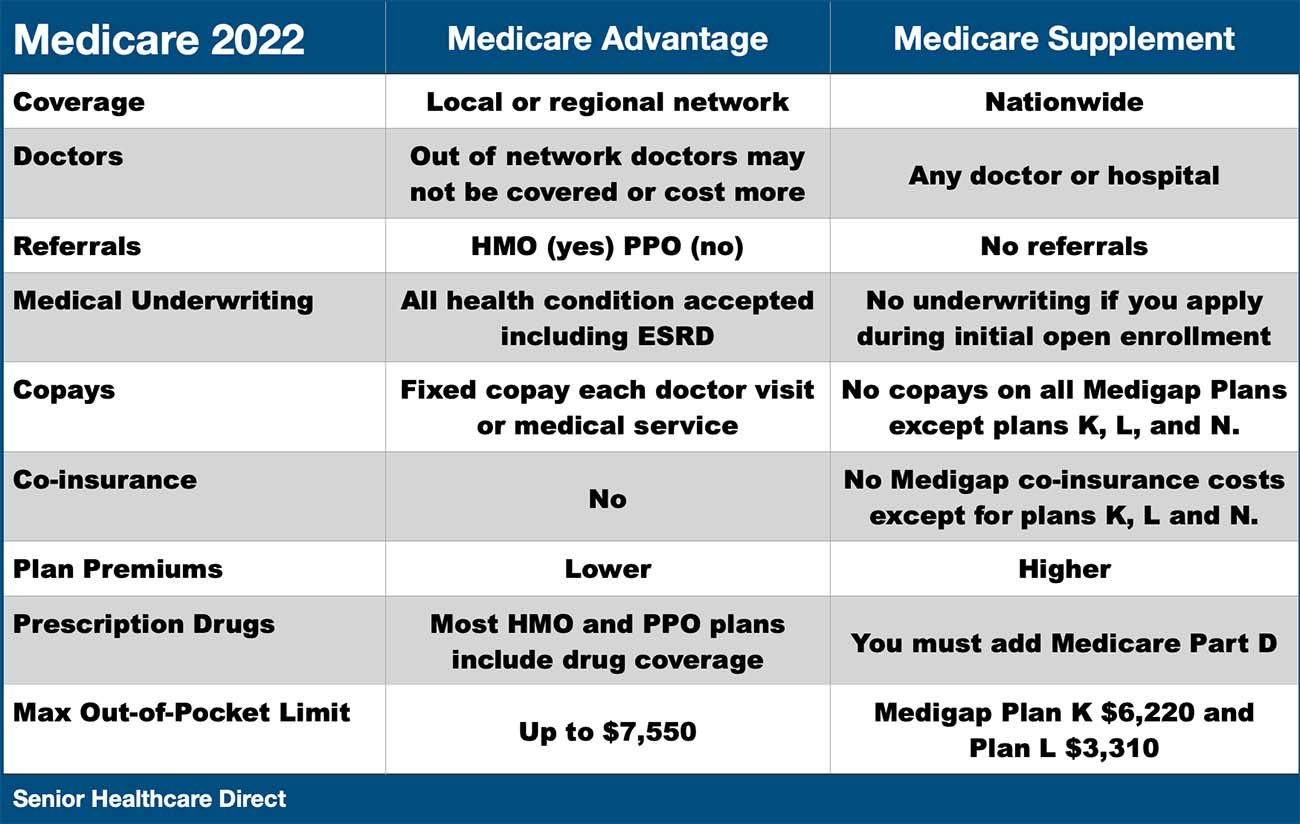

Called Medicare Supplement, Medigap insurance plans assistance load in the "voids" in Original Medicare by covering a portion of the out-of-pocket expenses Over after Medicare Part A as well as B insurance coverage. The exact protections rely on the sort of strategy that is acquired and which specify you reside in.

Called Medicare Part C.

With Component B, Medicare usually pays 80% and also the individual pays 20%. With Part A, there's a deductible that applies to each benefit period for inpatient treatment in a healthcare facility setup.

Medigap Can Be Fun For Anyone

If you require healthcare solutions while traveling beyond the United States, it's important to recognize that Original Medicare does not cover emergency situation health care services or products beyond the united state Nevertheless, there are some points that Medicare supplement insurance coverage typically does not cover, such as vision or dental treatment, spectacles, listening to aids, private-duty nursing, or lasting treatment.

Medigap prepares might help you decrease your out-of-pocket medical care expenditures so you can get cost effective treatment for comprehensive health care throughout your retirement years. Medicare supplement strategies may not be best for every situation, however recognizing your options will certainly assist you choose whether this type of protection could aid you manage medical care expenses.

Journalist Philip Moeller is below to offer the answers you need on aging as well as retired life. His regular column, "Ask Phil," intends to help older Americans as well as their family members by addressing their health treatment and financial questions.

The Facts About What Is Medigap Uncovered

The largest space is that Part B of Medicare pays only 80 percent of protected expenditures. More than likely, even more individuals would acquire Medigap strategies if they could afford the month-to-month costs. Virtually two-thirds of Medicare enrollees have fundamental Medicare, with concerning weblink 35 percent of enrollees instead picking Medicare Advantage strategies.

Unlike various other personal Medicare insurance plans, Medigap strategies are controlled by the states. And while the particular protection in the 11 various types of strategies are dictated by government regulations, the rates and schedule of the strategies depend upon state guidelines. Federal guidelines do give guaranteed concern civil liberties for Medigap purchasers when they are new to Medicare and also in some conditions when they change between Medicare Benefit and standard Medicare.

Once the six-month duration of government mandated civil liberties has passed, state guidelines take over establishing the rights people have if they want to buy new Medigap plans. Right here, the Kaiser table of state-by-state rules is very useful. It must be an obligatory quit for anyone considering the role of Medigap in their Medicare plans.

A Biased View of Medigap

I have actually not seen tough information on such conversion experiences, and regularly go to these guys tell visitors to evaluate the marketplace for brand-new plans in their state before they change right into or out of a Medigap strategy during open enrollment. I presume that anxiety of a possible problem makes several Medigap insurance policy holders resistant to change.

A Medicare Select plan is a Medicare Supplement plan (Strategy A via N) that conditions the repayment of benefits, in whole or partly, blog on using network carriers. Network carriers are providers of healthcare which have actually gotten in right into a composed contract with an insurance company to supply benefits under a Medicare Select policy.